“Do more with less” is the ironic refrain that most sales and marketing leaders have heard throughout their careers. In 2025, AI might finally be making it possible. But not in the way that you’d expect.

Our third annual B2B Sales & Marketing Benchmark Report, analyzing the survey of 177 B2B sales and marketing leaders in August 2025, shows near-universal AI adoption. Yet very few teams can prove top-line impact. The strongest claim we’re hearing from revenue leaders is that AI is helping their teams operate faster and leaner – not necessarily sell more.

Still, the data reveals something worth exploring: companies with the most mature AI use cases are more likely to outperform revenue targets and demonstrate tighter sales and marketing alignment, even as budgets and headcount shrink.

Companies with the most mature AI use cases are more likely to outperform revenue targets and demonstrate tighter sales and marketing alignment, even as budgets and headcount shrink.

This is only a correlation, yet we found ourselves wondering: what if the technology itself isn’t the driver? Successful AI adoption requires operational rigor, such as clean data, shared KPIs, and clear workflows between teams. Though AI might be shaping a new operational model, it’s also likely rewarding the teams that have mastered the fundamentals: ICP clarity, category positioning, demand gen strategy, and integrated revenue team plays.

Do more with less. Let AI do it.

The funding environment has shifted in the last 3 years, closing the door to the “growth at all costs” model. Except for the hottest AI-native startups, companies across every stage have recalibrated their spend, opting to extend runways and preserve optionality for raising future capital.

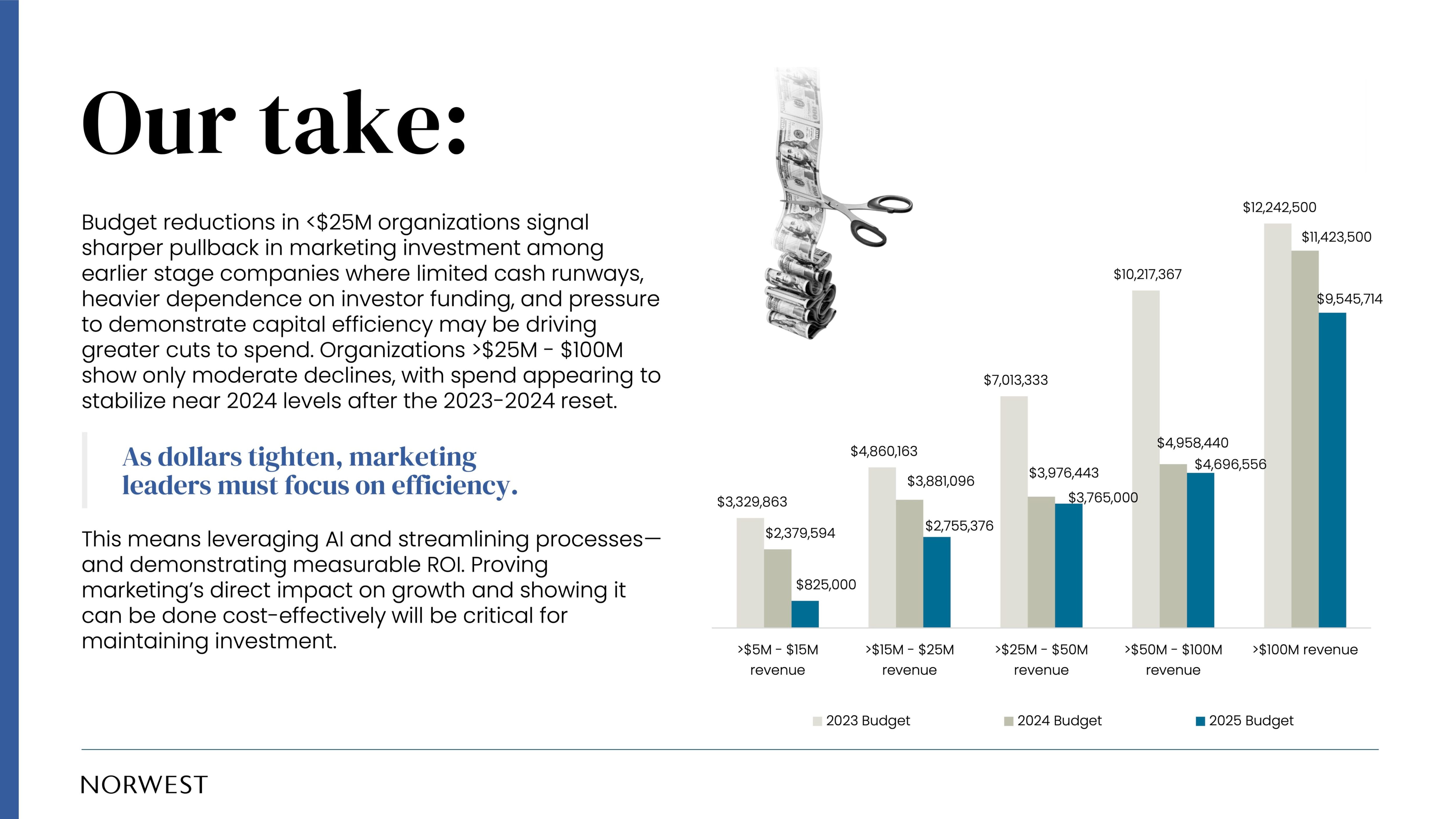

Revenue teams have felt the spend pullback acutely. Marketing budgets are half of what they were when we first launched this survey in 2023.

In 2024 we saw what looked like a scale-up/growth-stage correction in marketing spend that has now cascaded to a pullback on both ends of the market: budgets have plummeted at start-ups under $25M in revenue and mid-market companies over $100M. This doesn’t appear to be a temporary constraint. We’re seeing a full reset in how go-to-market teams are resourcing growth.

Under this mounting pressure, AI emerged as a savior. When OpenAI launched ChatGPT, marketers were told to cut their content budgets and creative teams while sales leaders reengineered their outbound motions using AI for market intelligence and personalized delivery. The role of “GTM Engineer” was born as GTM teams raced to embrace AI.

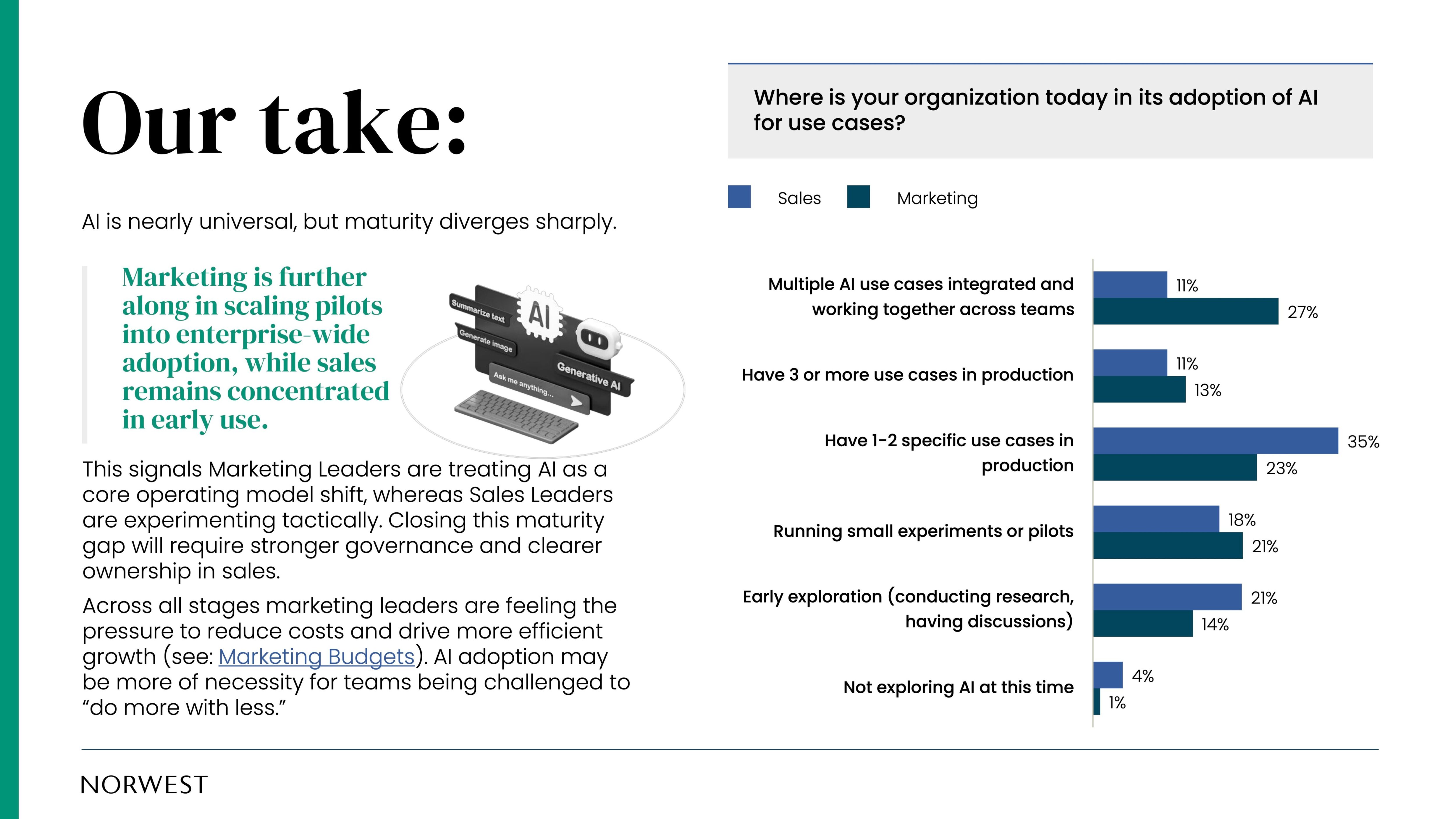

Today AI adoption is nearly universal. 99% of marketing leaders and 96% of sales leaders report they are using or experimenting with AI. And more than half of sales and marketing leaders have deployed AI in production.

As much as marketing leaders might groan at the “do more with less” trope, the data shows that AI is reinventing the operating model and helping teams operate leaner, even as they struggle to quantify its impact.

Everyone is using AI. But don’t ask them about ROI.

Despite ubiquitous adoption, only about one in eight revenue leaders tie their AI use to pipeline growth or improved conversion rates.

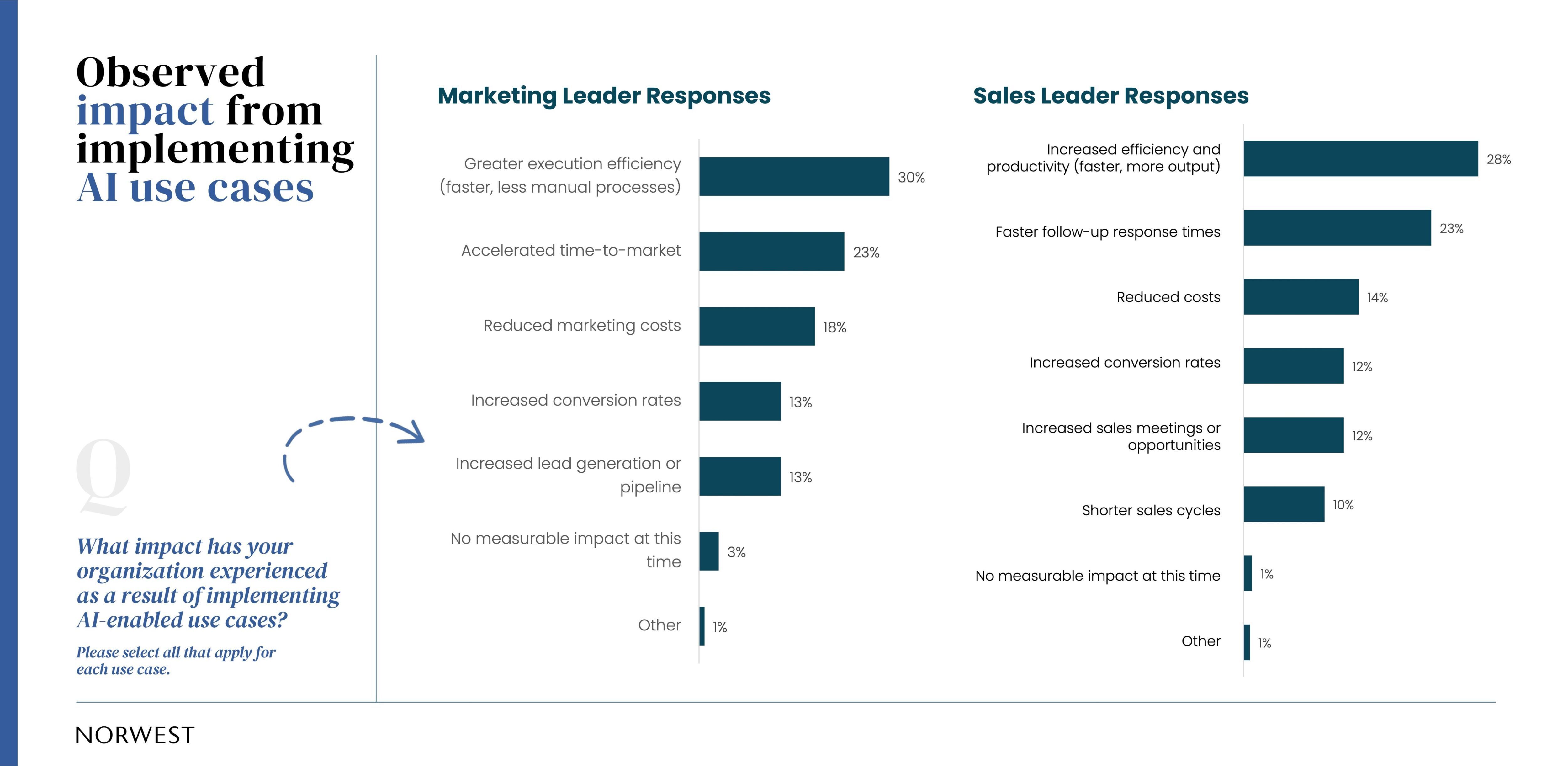

Teams say they’re moving faster, with 28% of sales leaders and 30% of marketing leaders reporting improved efficiency. Further, 23% of marketing leaders claim “accelerated time-to-market” from AI use, and the same percentage of sales leaders reported faster follow-up response times.

But sourcing revenue? As few as 13% of marketing leaders claim AI has improved conversion rates or led to more pipeline. Sales leaders weren’t any more confident with 12% or fewer reporting a link between their AI use and increased opportunity creation or shorter sales cycles.

Teams aren’t investing in building the tech. They’re investing in their teams to learn it.

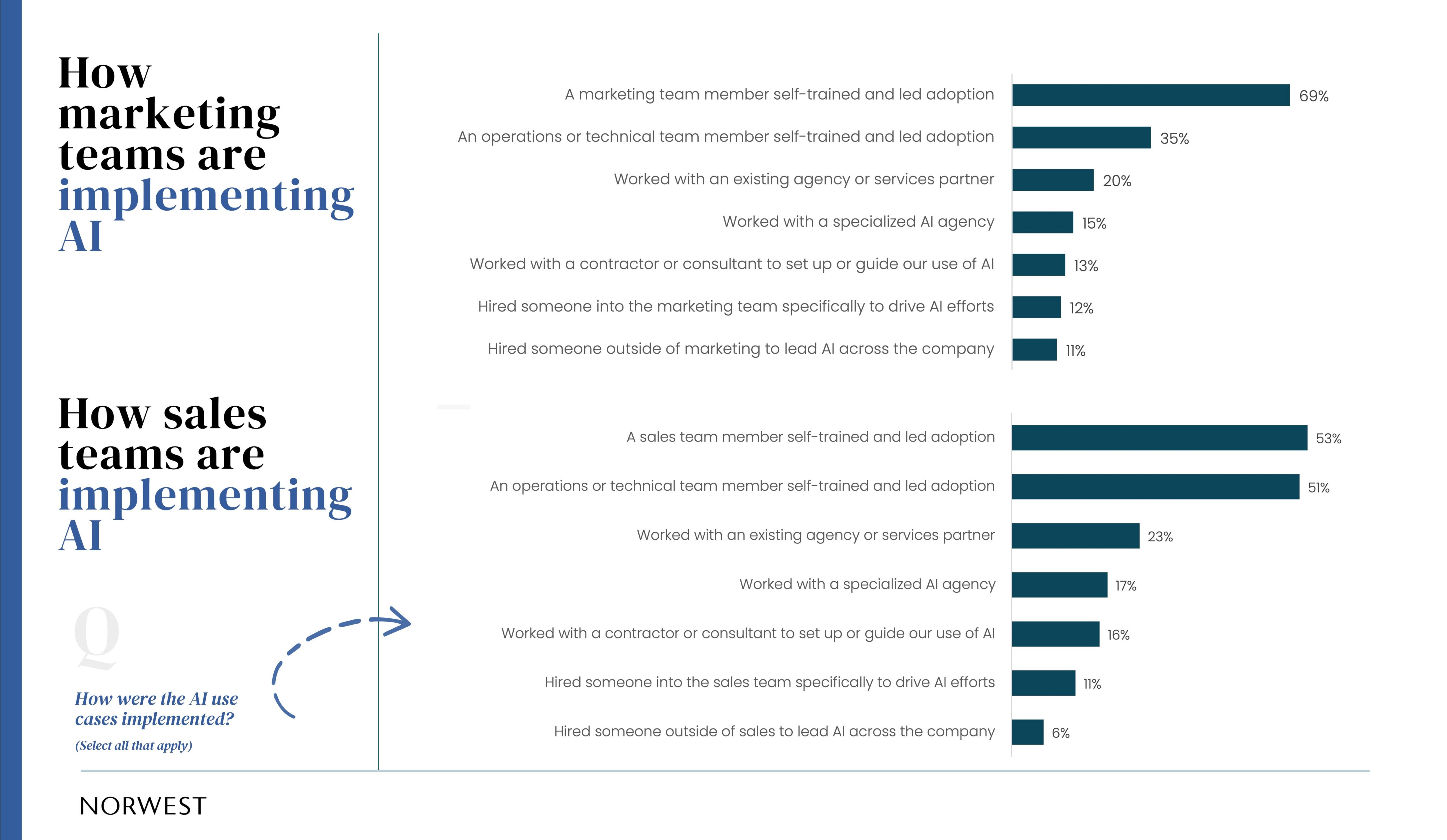

Rather than hiring AI experts, a majority of revenue leaders are taking a grassroots approach to adoption; 53% of sales leaders and a staggering 69% of marketing leaders report AI adoption has been led by a sales or marketing team member who is self-trained.

Only about one in five marketing leaders report contracting with an agency or consultant to roll out AI, suggesting teams are taking a very “bottoms up” approach to adopting AI into their sales and marketing workflows.

So even as teams have been pulling back on spend over the last two years, they’ve made progress against AI adoption through DIY rollout. This points to AI adoption out of necessity, rather than top-down mandates.

And this behavior says as much about the operational shift as it does about budget constraints. Implementing AI isn’t just about automation. It’s about creating shared language, goals, and outcomes. While AI adoption might look universal, its impact depends on internal maturity. Teams that can document processes, clean their data, and teach themselves new tools are leading the way.

While teams are getting smaller, few blame AI.

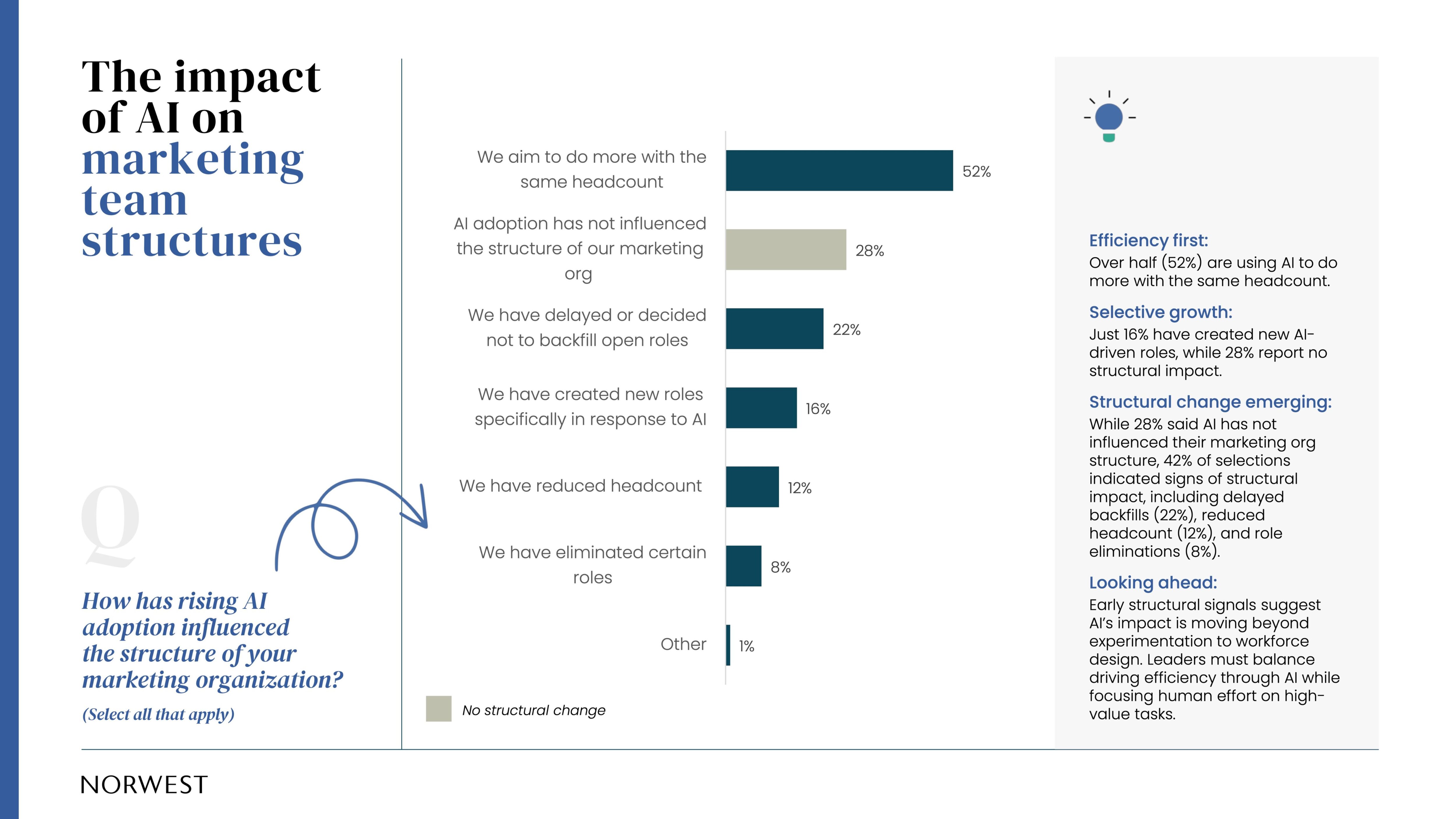

Despite the incessant headlines about AI coming for jobs, only 12% of marketing leaders report that they have reduced headcount on their team as a result of AI. And 16% have even added new roles, outpacing the reported cuts.

Whether AI is to blame or not, marketing leaders at orgs over $6 million in revenue report that their teams have gotten about 20-25% smaller year over year. As budgets are slashed and AI adoption rises, it’s surprising to see revenue leaders give AI a pass on its impact in workforce reductions.

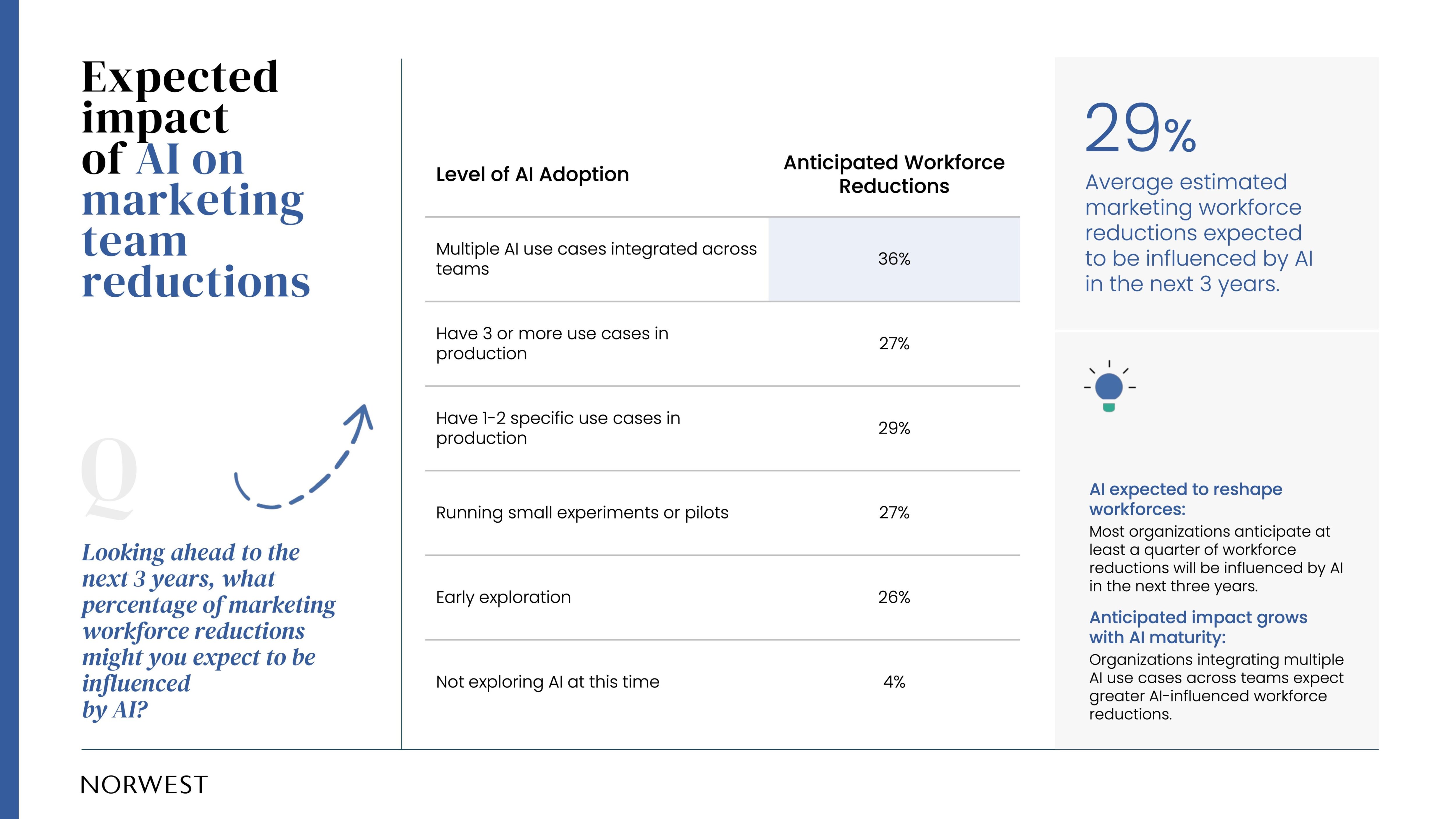

Marketing leaders aren’t completely burying their heads in the sand, though. On average, they believe the marketing workforce will be reduced by about 29% over the next 3 years as a result of AI. However, those with more mature AI adoption see AI’s impact on the marketing workforce to be even greater than that, predicting it will be 36% smaller in the next three years.

And more than half of marketing leaders see the writing on the wall that AI will at least allow them to keep their orgs flatter, longer (52% report that AI will allow them to do more with the same headcount). This suggests marketing leaders have optimism there is scale that remains to be unleashed from AI.

Marketing roles that are in demand may not have “AI” in the title.

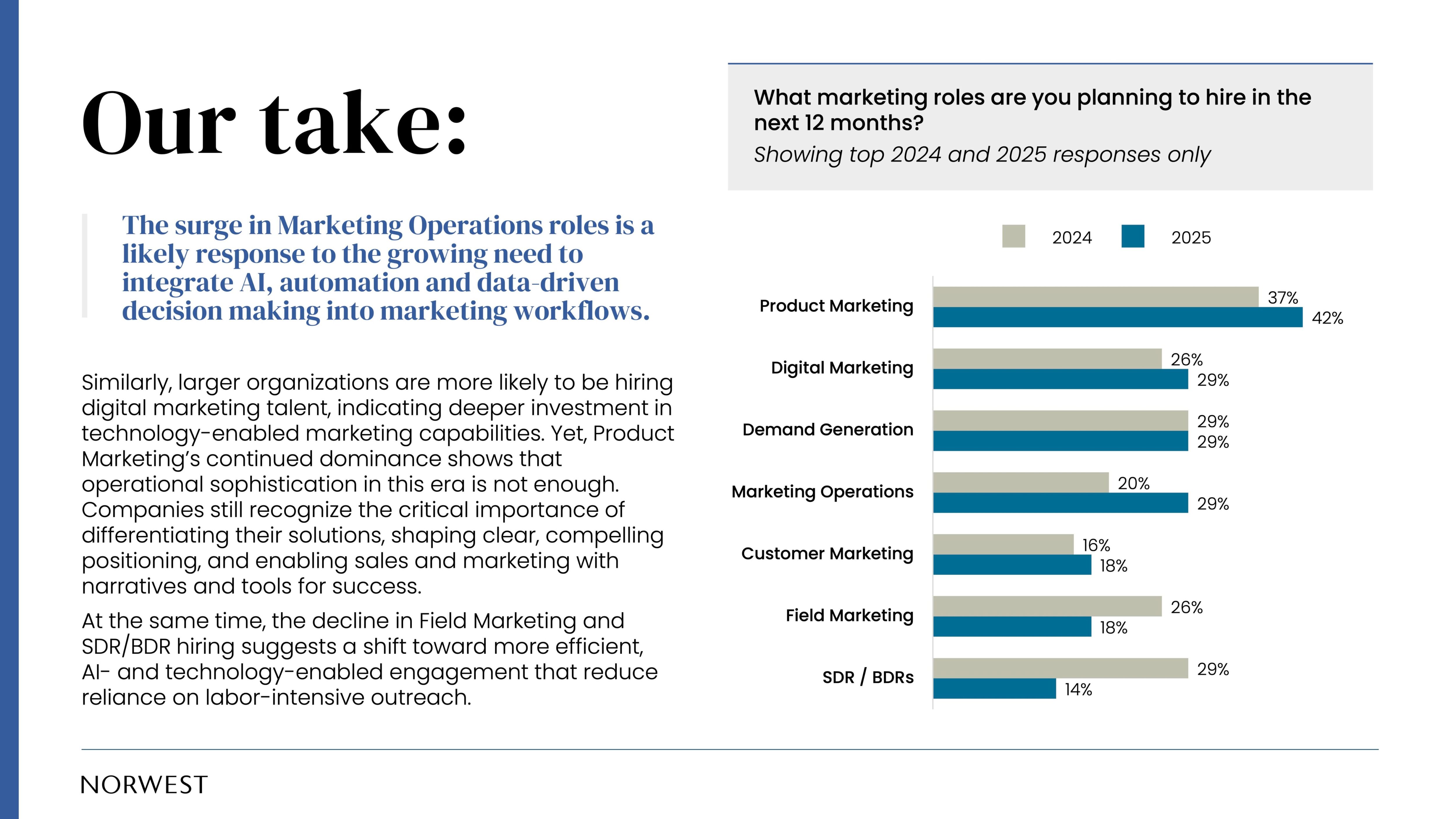

With so much self-driven AI-adoption, ops roles are in high demand. 29% of marketing leaders are planning to hire marketing operations in the next 12 months, a jump of nine percentage points from 2024, the largest increase in demand across all the other functions.

This is to be expected. AI adoption requires a strong operational foundation: good data hygiene, workflow documentation, technology selection, and template development.

And product marketing leads as the number one role in demand, with 42% of marketing leaders planning to hire PMMs as we head into 2026, signaling a focus on generating market insights, positioning, messaging, competitive differentiation, and ICP.

When we think about what drives successful AI use, these two roles make complete sense. To operate AI effectively, product marketing gives strategic clarity to LLMs, and marketing operations provides the systems clarity.

AI might not be automating every job it’s impacting.

SDR / BDRs and Field Marketing are two roles marketing leaders have significantly pulled back on hiring year over year.

One is a head-scratcher. The field marketing role typically requires in-person interaction, indicating much of the role can’t be automated to AI. And we see no evidence that field marketing tactics are slowing down.

In 2024 Events/Tradeshows and Field Marketing were approximately 24% of the marketing programs budget. We adjusted the option in the 2025 budget breakout into Events & Sponsorships, which averaged 38% of the marketing programs budget. As AI begins to drive efficiency, we could see field marketing responsibilities getting absorbed into other demand gen functions.

On the other hand, the SDR / BDR function has been ripe for automation. In our work across the portfolio, we are hearing more about the uptick in “BDR-less Outbound” (like Lavender.ai Ora) and “Inbound SDR Automation” (Iike Qualified PiperX). With decelerating demand in SDR/BDR hiring next year, marketing appears to be increasingly on the hook for generating meetings for sales.

This signals that AI may be closing the gap between functions. As teams operate leaner for longer, roles will continue to consolidate.

AI may be hastening the death (and rebirth) of the MQL.

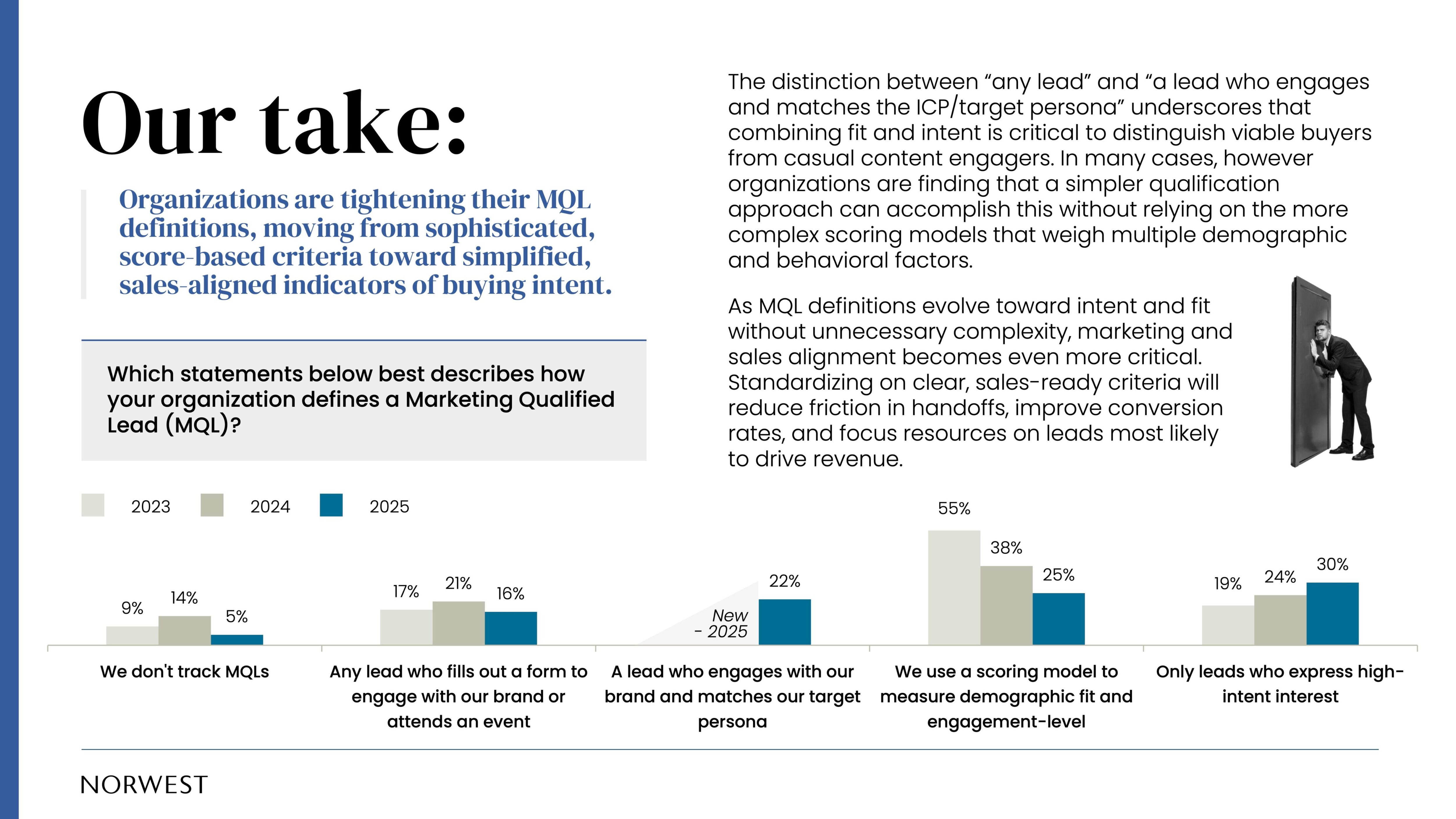

The MQL that SiriusDecisions introduced nearly 20 years ago is finally losing its grip. Only one quarter of marketing leaders still use lead scoring to define their MQLs. When we first launched this survey in 2023, the scoring model was (unfortunately) the standard with 55% of marketing leaders using it. My issues with the MQL scoring model are well-documented atop the sturdy soapbox I’ve dusted off each year doing this report.

Now 22% of marketing leaders report they are prioritizing ICP match in their MQL definition. And 30% of marketing leaders are prioritizing quality of engagement (up from 19% in 2023), saving the MQL designation for high-intent hand-raisers (demo requests, talk to sales).

While we haven’t given up reliance on the MQL yet, I am encouraged to see marketing leaders spending fewer calories “tinkering” with their ops recipes and more time feeding their sellers high-intent or ICP-fit leads. This should make every hand-off to sales more meaningful with less noise for sales to sift-through. (Ever sat in the “why did this lead MQL?” meeting?)

Now the most popular MQL definition is anchored toward “hand-raisers” – someone who is ready for the demo or the meeting. Whether AI is enabling this shift by making it easier to identify high-intent signals, or whether leaner teams simply can’t afford to chase low-quality leads anymore, the result is the same: marketing is feeding sales better opportunities with less noise. And there’s evidence that AI maturity and marketing’s impact on revenue go hand-in-hand.

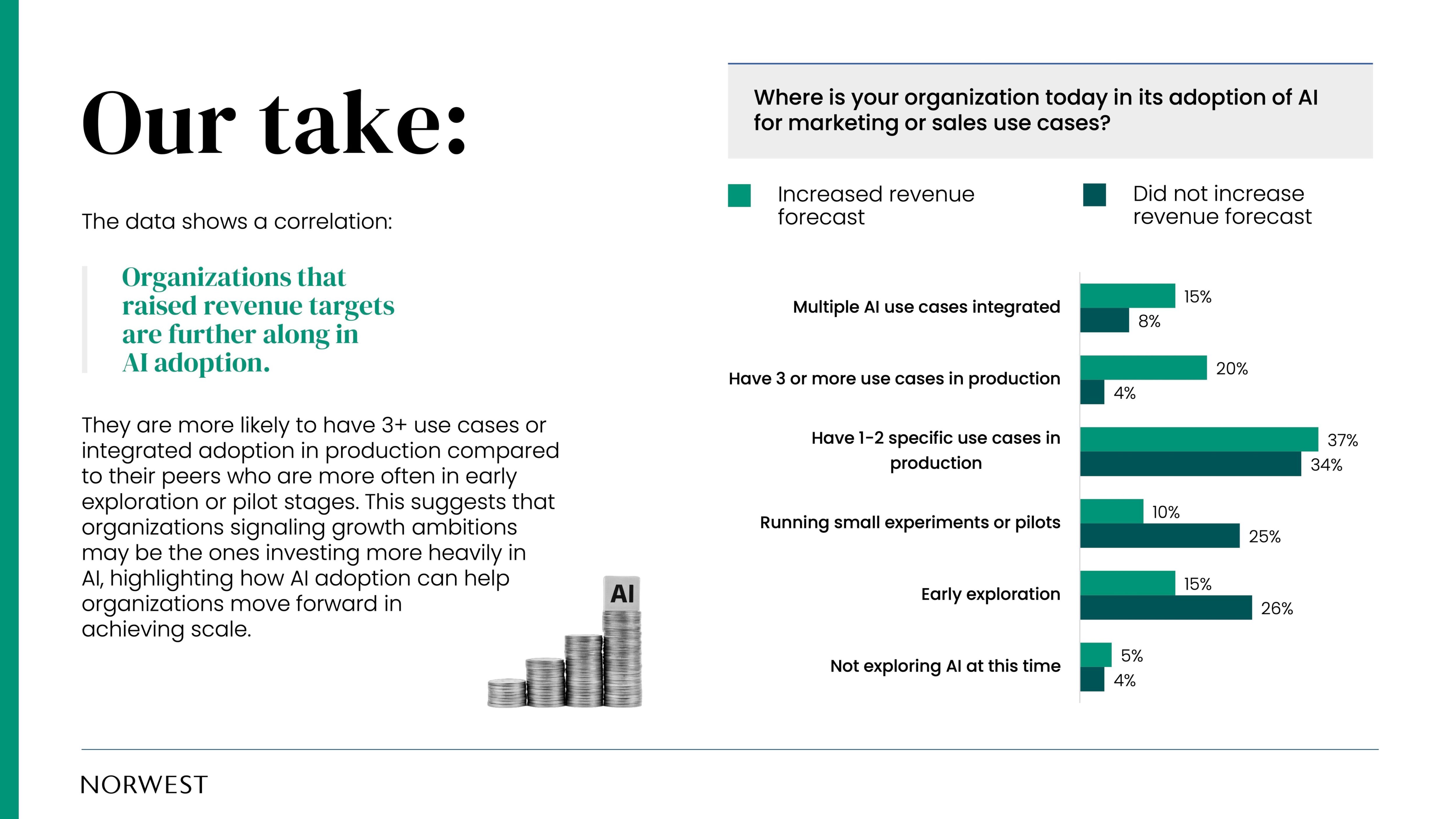

35% of companies that increased their revenue forecast had advanced AI maturity with three or more use cases in production. Only 12% of companies who had flat or lowered forecasts had three or more use cases. While only a correlation, this suggests companies with advanced AI maturity are more likely to exceed their revenue targets.

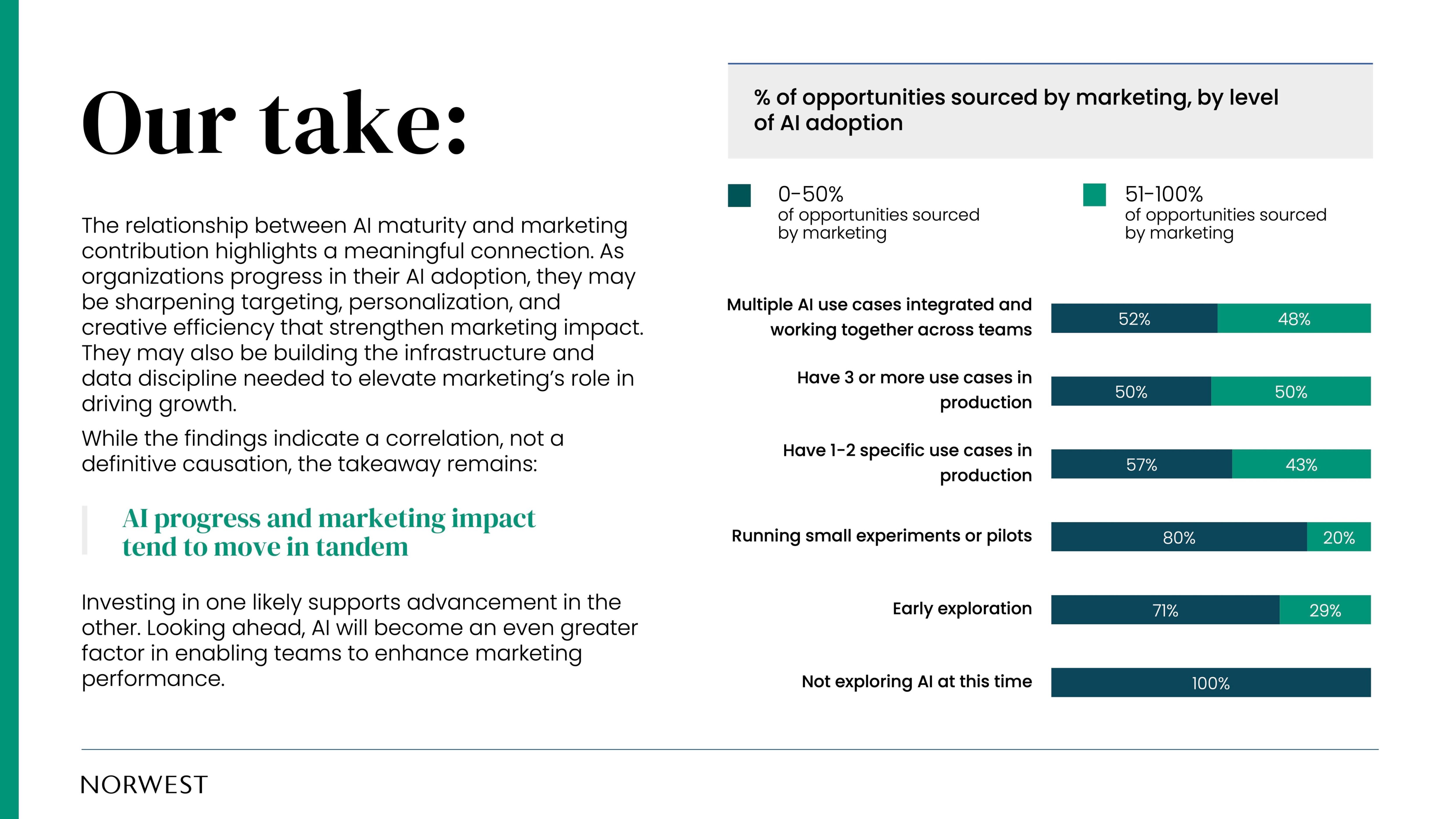

We’re also seeing AI maturity seemingly influence the percentage of opportunities sourced by marketing. Teams with AI use cases in production were about 1.5-2.5x more likely to have the majority of opportunities sourced by marketing compared to those experimenting.

All of these signals indicate that marketing is getting closer to revenue creation. The KPIs are clearer, behavior is shifting to warm opportunity hand-offs, and the marketing teams using AI in production are significantly likely to source more opportunities than those experimenting.

Alignment around the fundamentals always wins.

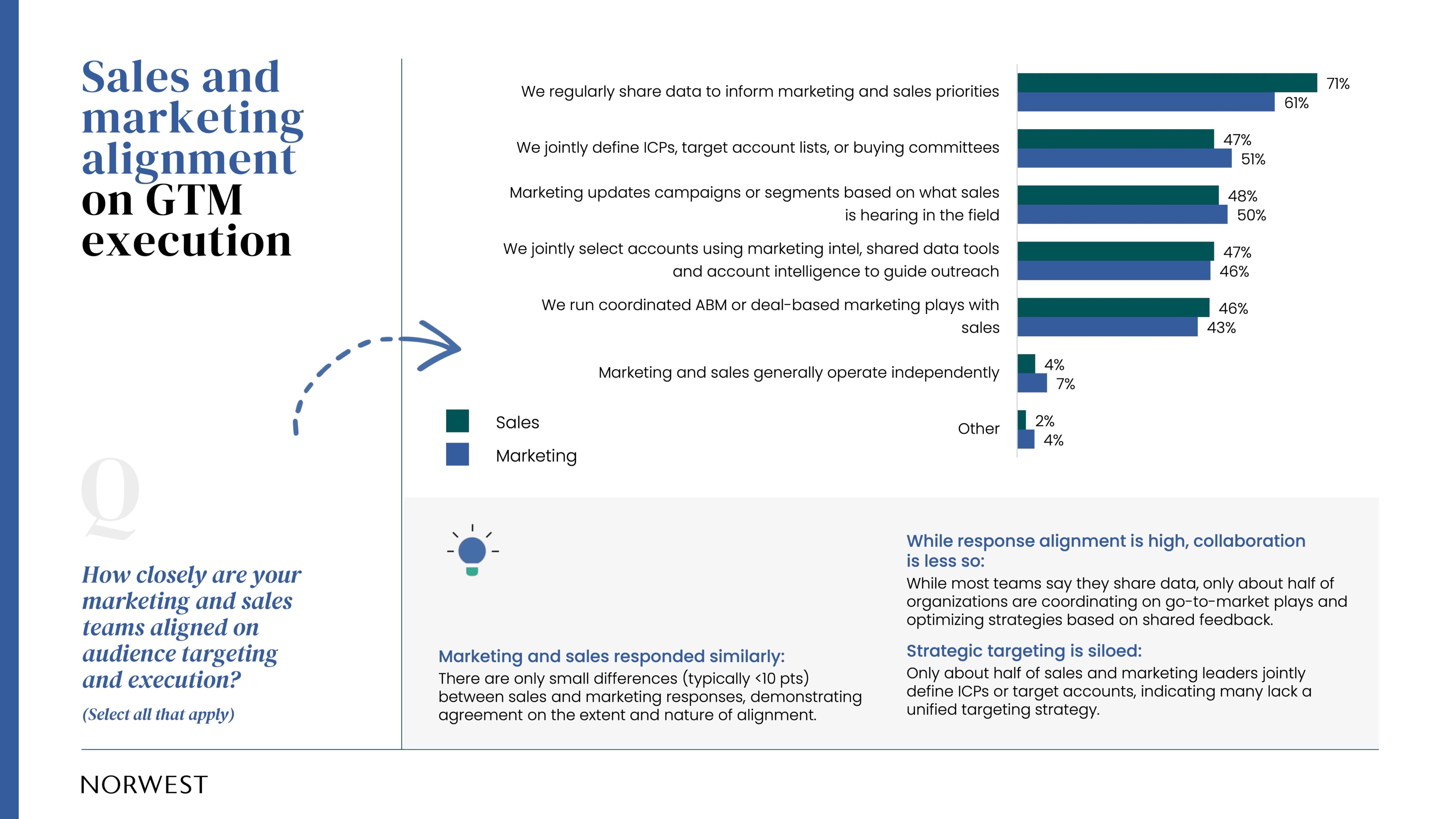

While there’s promising data suggesting AI is driving tighter alignment between sales and marketing, nearly half of GTM organizations struggle with shared definitions of success. Only about half jointly define their ICP or target account lists…or even run coordinated plays into those accounts.

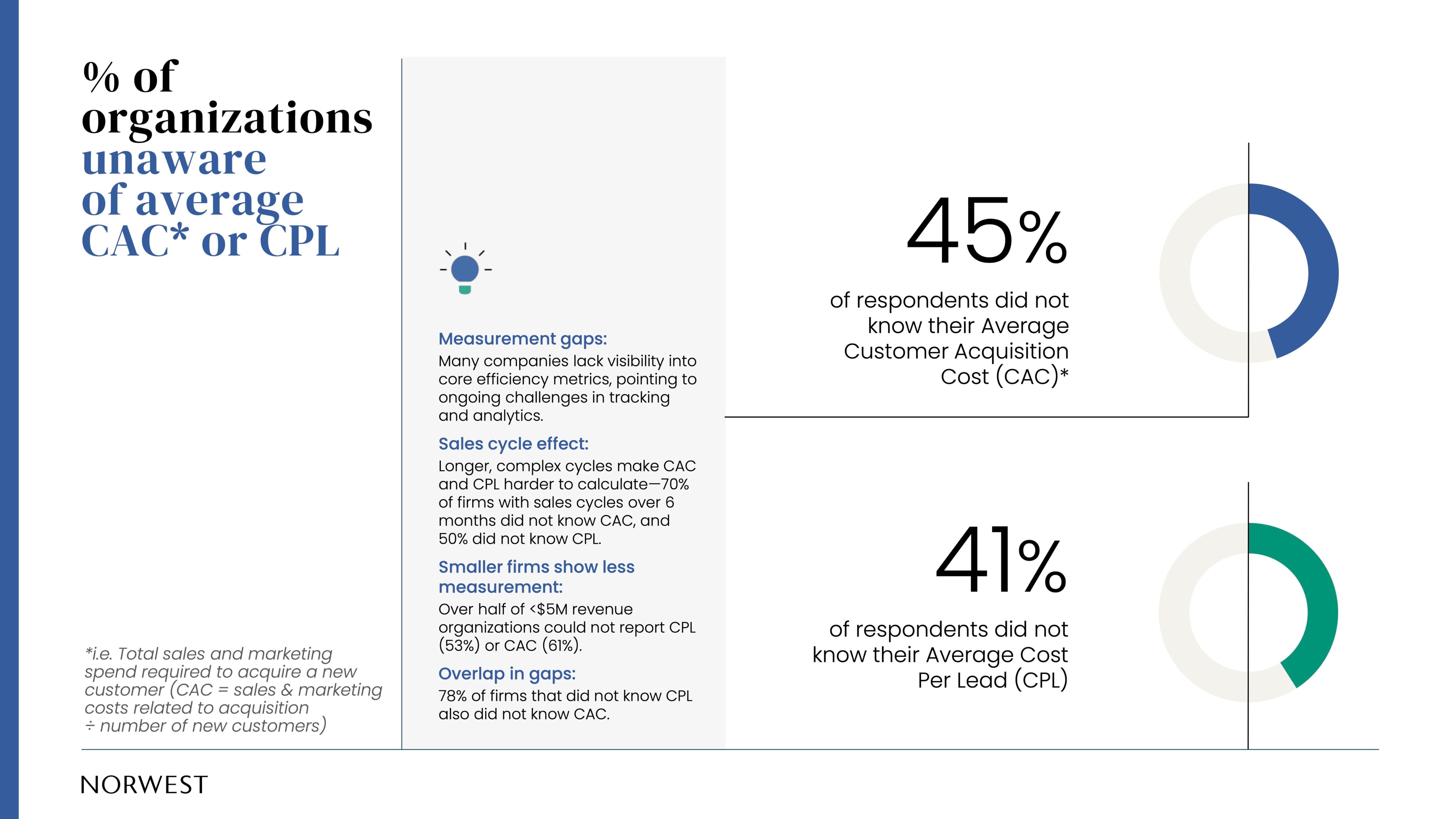

But the most instructive finding this year wasn’t about alignment. It was about accountability: 45% of revenue leaders don’t know their cost-to-acquire a new customer.

Understanding CAC means understanding your company’s own economics. How can marketing leaders propose programs without understanding how spend works in context of ACV and payback period?

To address this, marketing, sales, and finance leaders should run a shared data room. If your head of marketing doesn’t know how the business reports on CAC, teach them. If your head of finance can’t see how pipeline is built, show them. Shared math is the ultimate alignment strategy.

After three years of running this benchmark, one pattern is consistent: Technology doesn’t replace fundamentals. It exposes them.

While AI is transforming how GTM teams operate, it also appears to be rewarding those who are disciplined enough to build the data infrastructure and operational rigor needed to apply AI across teams.

And if these trends show that AI continues to bring sales and marketing closer together, it may fulfill more than its promise of efficiency. It may finally deliver revenue alignment that the industry has been chasing for decades.

Download the 2025 B2B Sales & Marketing Benchmark Report

Thank you to our partners at Marketbridge who worked with me to conduct this report and analyze the findings. It’s a privilege to share this report with the Norwest portfolio and beyond.