Digital assets have emerged as one of the most transformative shifts in financial infrastructure over the past decade. What began as a wave of crypto-native experimentation has evolved into a growing suite of technologies reshaping how money is stored, moved, and accessed.

Stablecoins are among the most widely adopted forms of digital assets. In the past year, they accounted for over two-thirds of global digital asset transaction volume, with over $200 billion in circulation. Businesses and consumers are embracing programmable dollars, unlocking faster, cheaper, and more accessible ways to store and move money globally.

While fintech and payment leaders like Stripe, PayPal, and Visa have raced to integrate digital asset technology into their product offerings, most banks have been left watching from the sidelines. Regulatory uncertainty, legacy systems, and the sheer technical complexity of digital assets have made it nearly impossible for them to participate.

Now, the tides are changing.

Why Now: A Moment of Clarity for Stablecoins

The regulatory landscape is finally catching up to the pace of innovation.

With the passage of the GENIUS Act, the first comprehensive federal stablecoin framework, U.S. financial institutions finally have the legal clarity they’ve been waiting for: clear standards for reserves, issuance, and oversight. Combined with the rollback of legacy restrictions like SAB 121, we’re entering a new chapter where banks can actively participate in the digital asset economy and integrate digital assets into their product offerings.

“We’re entering a new chapter where banks can actively participate in the digital asset economy and integrate stablecoins into their product offerings.”

Across the market, banks are no longer standing still. They’re actively developing their digital asset strategies — validating use cases from digital asset custody and tokenized deposits to stablecoin-powered money movement and treasury solutions.

As they explore how to meet rising demand for faster, more global financial services, they’re searching for infrastructure that is compliant, scalable, and enterprise-grade. Legacy systems are struggling to keep up, and the need for trusted providers with deep expertise is only accelerating.

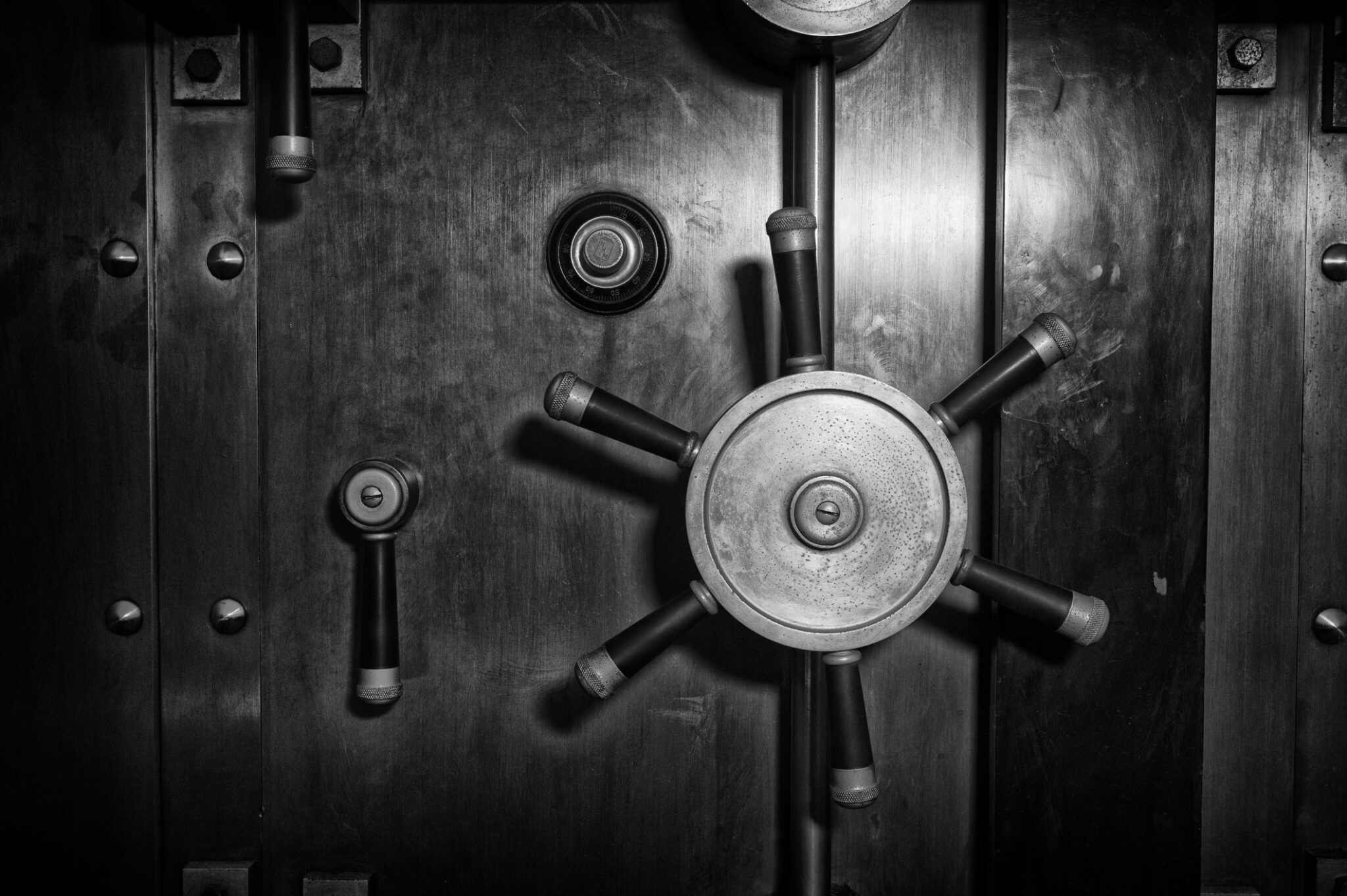

Introducing Stablecore

Stablecore is building a digital asset banking core: infrastructure purpose-built to help banks launch digital asset products. It’s a software-first platform that abstracts away the hardest parts of blockchain, including custody, compliance, orchestration, network integration, and account ledgering.

At the heart of Stablecore’s thesis is the belief that banks should be the trusted gateway to digital assets. These institutions already serve as a customer’s primary financial relationship and have built trust over decades.

By integrating with a bank’s existing core systems, Stablecore acts as a modular “side core.” It empowers institutions to offer modern digital asset experiences without having to rip out legacy infrastructure. Stablecore gives banks a way to lead rather than lag in this new era of programmable money.

“By integrating with a bank’s existing core systems, Stablecore empowers institutions to offer modern digital asset experiences without having to rip out legacy infrastructure.”

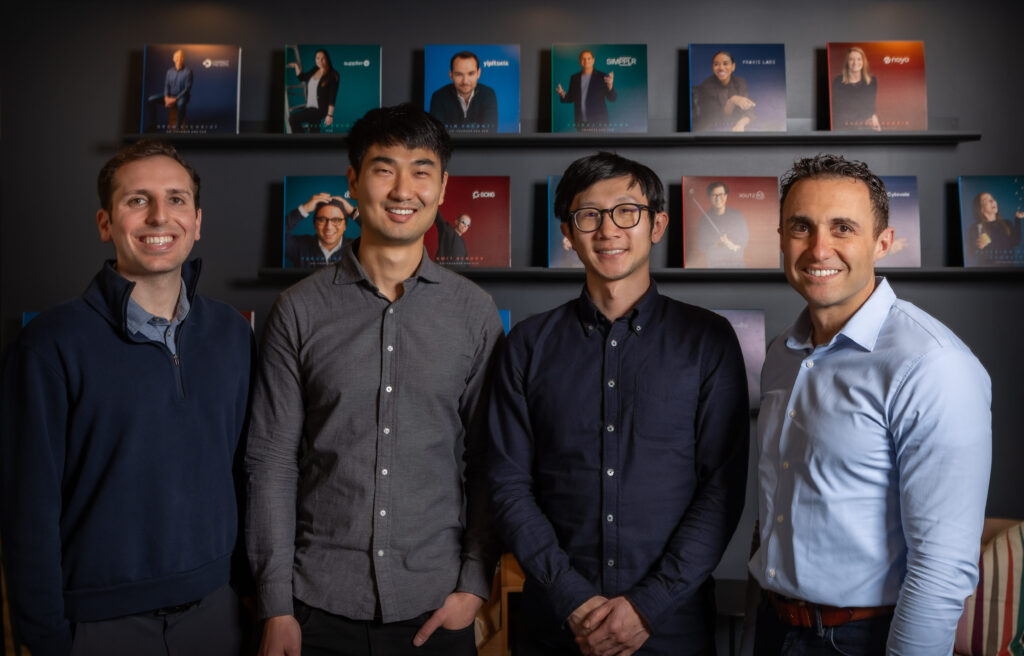

An Exceptional Team With a Clear Vision

Our conviction in Stablecore has only grown as we’ve gotten to know Alex Treece, Stablecore’s co-founder and CEO, throughout our diligence. That confidence has been echoed by many who’ve worked with him at Coinbase, where he was consistently described as a high-output operator with rare range. Alex has a clear vision and is deeply strategic, fast-moving, and unshakably focused on execution.

After Coinbase acquired Zabo, his first company, Alex launched and scaled Quests, one of Coinbase Wallet’s core monetization platforms. Alex quickly earned a reputation for leading cross-functional teams, building deep partnerships, and driving product velocity. He’s the kind of founder who can architect a backend system in the morning and close a strategic deal by the afternoon.

He’s joined by Eduardo Montemayor, an experienced blockchain engineer who led backend infrastructure at Coinbase and BRD (a crypto wallet company), and Nick Elledge, previously COO and Founder of DataFleets (acquired by LiveRamp), an encrypted data and AI platform, where he helped scale the company across operations, sales, and strategy. Stablecore has a well-rounded, high-trust team with the experience and urgency needed to move fast in a complex market.

What’s Ahead

Stablecore is moving quickly and listening closely to its design partners, and building the backbone we believe will enable banks to retain deposits, unlock new revenue streams, and stay competitive as digital assets reshape the financial system.

We’re proud to partner with the Stablecore team at this pivotal stage and to lead their seed round. If you’re a bank or financial institution thinking about your stablecoin strategy, Stablecore would love to hear from you. And if you’re a builder who wants to help reinvent financial rails from the inside out, the team is hiring!