You’ve built a thriving beauty brand from the ground up. Your DTC sales are strong, customers love your products, and you’re seeing healthy repeat purchase rates. But as you look ahead to the next phase of growth—perhaps expanding retail distribution, launching internationally, or building out your team—you realize you need a partner who can provide not just capital, but strategic resources and guidance for the journey ahead.

If this scenario sounds familiar, you’re not alone. The beauty and personal care industry continues to demonstrate remarkable resilience, with the global market expected to reach $590 billion by 2028, with a growth rate of 6% annually. As the market becomes more saturated with new entrants, strategic acquirers are increasingly focused on brands with genuine differentiation and staying power — making strong brand positioning more critical than ever.

Having spent the last five years at Norwest investing in growth-stage beauty and personal care companies, I’ve seen firsthand what separates successful capital raises from challenging ones. We work shoulder-to-shoulder with exceptional entrepreneurs and management teams, empowering them throughout their journey of growing their business. During a webinar with Moss Adams, I shared insights on navigating this process, from understanding what investors look for to timing your raise strategically. Here’s what every beauty founder should know.

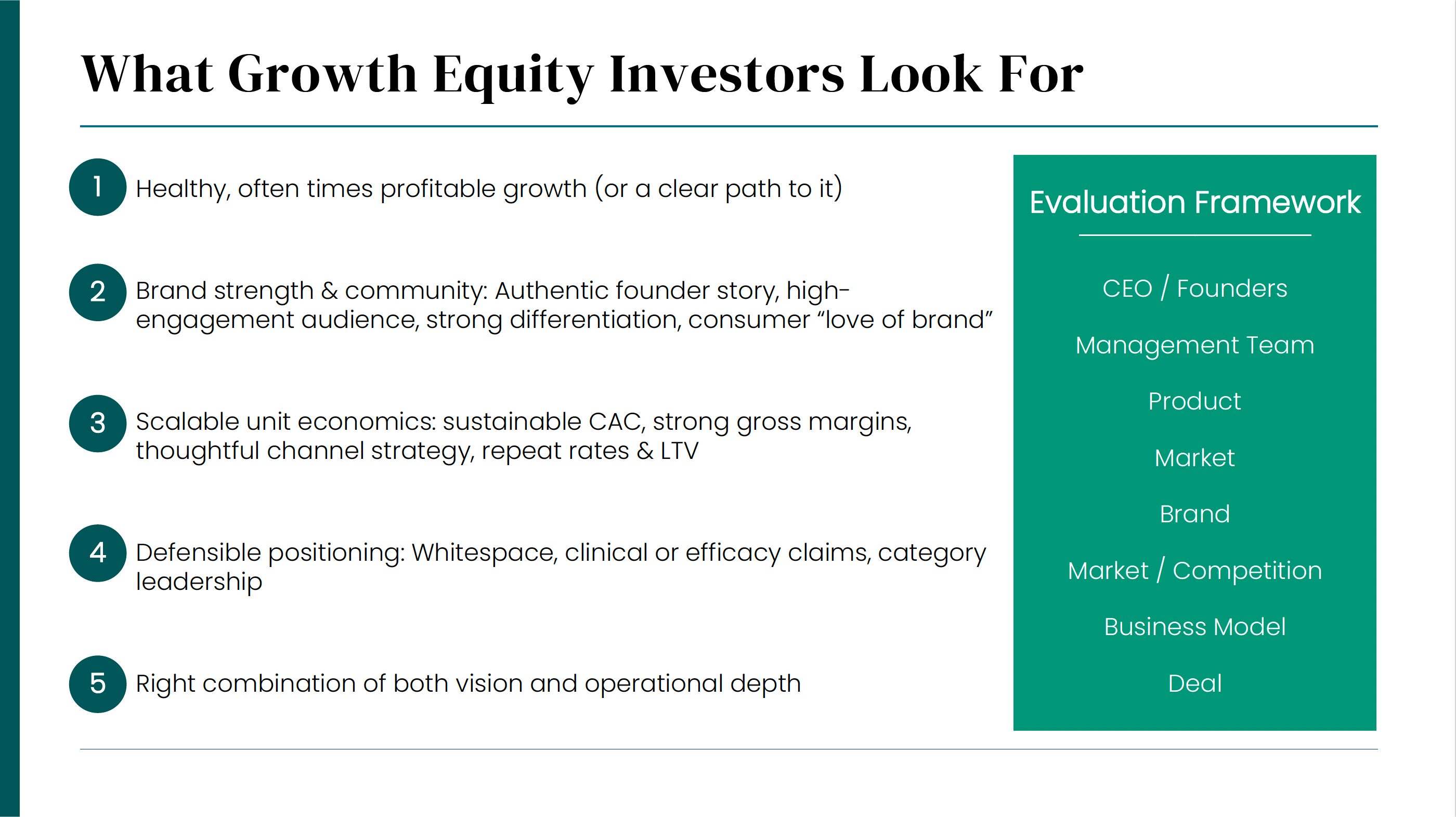

What Growth Investors Really Want

The beauty industry’s appeal to investors goes beyond just strong margins and consumer loyalty. Today’s investment firms are looking for businesses with scalable unit economics: sustainable customer acquisition costs with a quick payback, strong gross margins, and best-in-class repeat rates driving lifetime value.

The days of DTC-only strategies are largely behind us. While direct-to-consumer remains an important part of the flywheel, investors expect a thoughtful retail expansion strategy. The key is being strategic about timing and sequencing: understanding which retailers to enter first and how to set yourself up for success in each channel.

Beyond the numbers, investors are looking for brands that fill a genuine white space in the market and have built loyal communities with a real affinity for the brand. This could manifest through clinical efficacy claims, unique positioning, or an authentic founder story that resonates with consumers. Successful beauty brands in our portfolio demonstrate this across different approaches, from Divi founder Dani Austin, who used her hair loss journey as inspiration to launch a brand focused on promoting scalp health, to Face Reality’s personalized acne solutions delivered through trained aestheticians, to MAËLYS’s body-sculpting innovation that is expanding results-oriented skincare beyond the face.

Investors are looking for brands that fill a genuine white space in the market and have built loyal communities with a real affinity for the brand.

You don’t need a fully built-out team at the time of investment, but investors want confidence that current leadership can scale through the next growth phase and clarity on what gaps will need to be filled.

Positioning Your Business for Investment

Oftentimes founders start to have growth capital conversations long before a potential raise. Building relationships with potential investors early creates opportunities to showcase your progress in a lower-pressure environment and allows you to find investors who are genuinely excited about what you’re building.

Separately, maintaining strong financial hygiene and consistently tracking key metrics like CAC, LTV, repeat rates, and retail sell-through data will streamline the diligence process when you’re ready to raise, allowing investors to quickly assess your business model and making negotiations more efficient.

Equally important is your ability to clearly articulate your growth strategy and why your approach will work. This doesn’t mean you can’t ask for advice — bringing on a partner should provide another strategic voice — but the more thoughtful perspective you can bring on day one, the more confidence investors will have in your vision.

Whether you’re already in retail or planning your expansion strategy, demonstrating that you understand your channel strategy is crucial. How does your brand perform differently across channels? What’s your timing and cadence for launches? How will you ensure successful retail partnerships? These questions need clear, thoughtful answers that show you’ve done the strategic work.

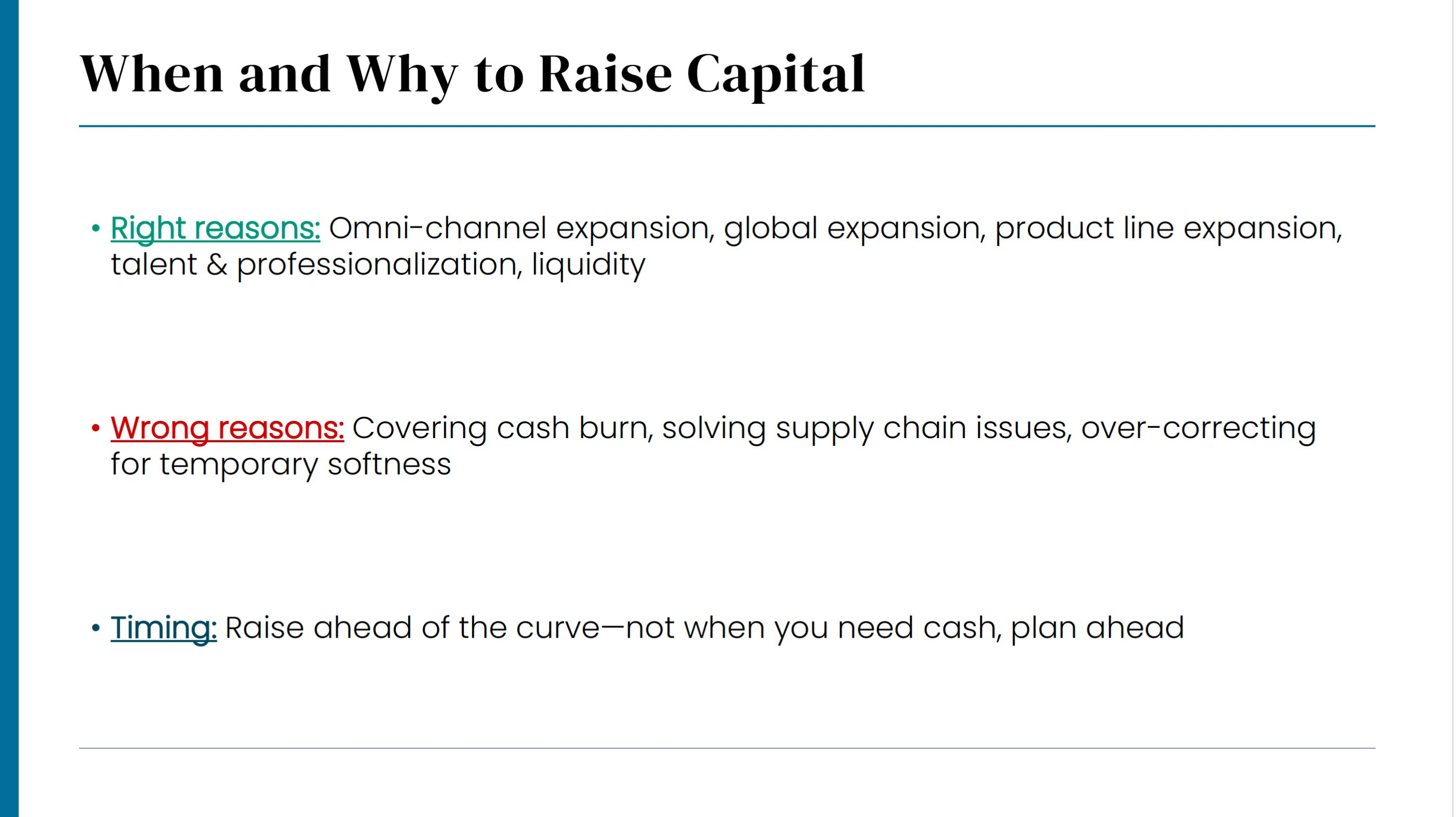

Timing Your Raise Strategically

One of the biggest mistakes I see founders make is waiting too long to start building relationships with investors and growing their network. The strongest positions come from raising funding ahead of the curve — when everything is going well and you want a partner to help navigate what’s next, rather than when you’re facing challenges and have an immediate need.

Consider raising when you’re approaching areas where you lack experience. If you’re planning a Target launch next year but have never brought a business into retail before, having experienced partners and additional resources could be invaluable. What you don’t want to happen is to be raising a year later when you’ve had some kind of issue with Target, or you’re just in a worse position.

This collaborative approach is central to how we work at Norwest. We lead with collaboration, not control, navigating the ups and downs of growth alongside our founders.

Other strategic reasons to consider growth capital include omnichannel expansion opportunities, global market entry, product line extensions, team building and professionalization, or personal liquidity and risk diversification. The common thread is that you want to be raising to accelerate growth and reduce risk, not to solve problems that are already impacting the business.

Choosing the Right Partner

While valuation matters, remember that in strategic growth equity partnerships, founders often roll significant ownership into the next phase. This makes partner selection critical. You want someone who will help maximize the outcome down the road, not just pay the highest price today.

You want a partner who will help maximize the outcome down the road, not just pay the highest price today.

Industry experience matters deeply. Have they invested in beauty and personal care before? Do they understand the nuances of your category? Can they provide retailer introductions, recruiting support, or introductions to people with the right operational expertise? Beyond capabilities, alignment is crucial. Are you aligned on growth expectations, timeline, and the level of day-to-day involvement?

Perhaps most importantly, talk to other founders who’ve worked with the firm, especially during challenging periods. Understanding how potential partners operate when things get tough — whether they’re the type to be in the trenches with you figuring it out or applying external pressures without support — can make all the difference in what will be a long-term relationship.

Lessons from the Fundraising Process

Having navigated the fundraising process alongside numerous founders, here are my top pieces of advice:

Under-promise and over-deliver: Put forward forecasts you’re confident you can achieve and potentially exceed. If you’re not hitting projections during the diligence process, it weakens your position significantly.

Prepare for scrutiny: Expect detailed examination of growth sustainability, channel dependency, customer acquisition trends, retention metrics, and promotional spending patterns.

Know this is a long-term partnership: Take time to get to know potential partners. Understand their expectations and targets, and that those align with your vision for the business. You need to be marching toward the goal — any conflicting objectives can cause major issues down the line.

Looking Ahead

The beauty and personal care industry continues to evolve rapidly, with new categories emerging, consumer preferences shifting, and technology creating new opportunities for brand building and customer engagement. For founders who have built successful businesses and are ready for the next phase of growth, the right growth equity partner can provide both the capital and strategic support needed to capture these opportunities.

At Norwest, our long-term commitment and collaborative approach gives entrepreneurs the trust and space to pursue their vision, backed by the experience needed to succeed. We operate with conviction and a commitment to long-term partnership, inspiring loyalty with our entrepreneurs as they choose to work with us again and again.

The key is approaching the fundraising process strategically: preparing early, understanding what investors are looking for, and finding partners who are truly aligned with your vision and values. When done right, growth capital can be transformative, providing not just funding but the expertise and network needed to build lasting, category-defining brands.

Lauren Beauchamp is a Vice President at Norwest, a leading venture and growth equity investment firm that works side-by-side with the world’s top entrepreneurs. Managing more than $15.5 billion in capital, Norwest has invested in over 700 early-to-late-stage companies, with more than 250 currently active. Norwest’s beauty and personal care portfolio includes PCA Skin, Face Reality, MAËLYS, Divi, and Aesthetic Partners. This article draws from insights shared during a recent webinar on navigating growth capital in beauty and personal care, hosted by Moss Adams.