Globally, a new class of fintechs is harnessing the power of stablecoins and digital asset technology. These stablecoin native companies are creating new financial products that were structurally and economically impossible on legacy rails and are reaching users far beyond the limits of traditional financial services.

Instead of working around incumbent systems, they’re designing new ones. The result is a new financial stack that is redefining how money moves in a world that’s rapidly becoming tokenized.

These stablecoin native companies are creating new financial products that were structurally and economically impossible on legacy rails and are reaching users far beyond the limits of traditional financial services.

At the same time, regulatory clarity in the U.S. has accelerated the convergence of traditional finance and digital assets. Banks, PSPs, and corporates are no longer experimenting on the periphery, they’re embedding stablecoins into everyday payment and treasury workflows. It’s the clearest sign yet that stablecoins are moving from innovation to inevitability.

This is the beginning of Fintech 3.0, an era defined by programmable digital dollars and borderless financial infrastructure with stablecoins as the foundation.

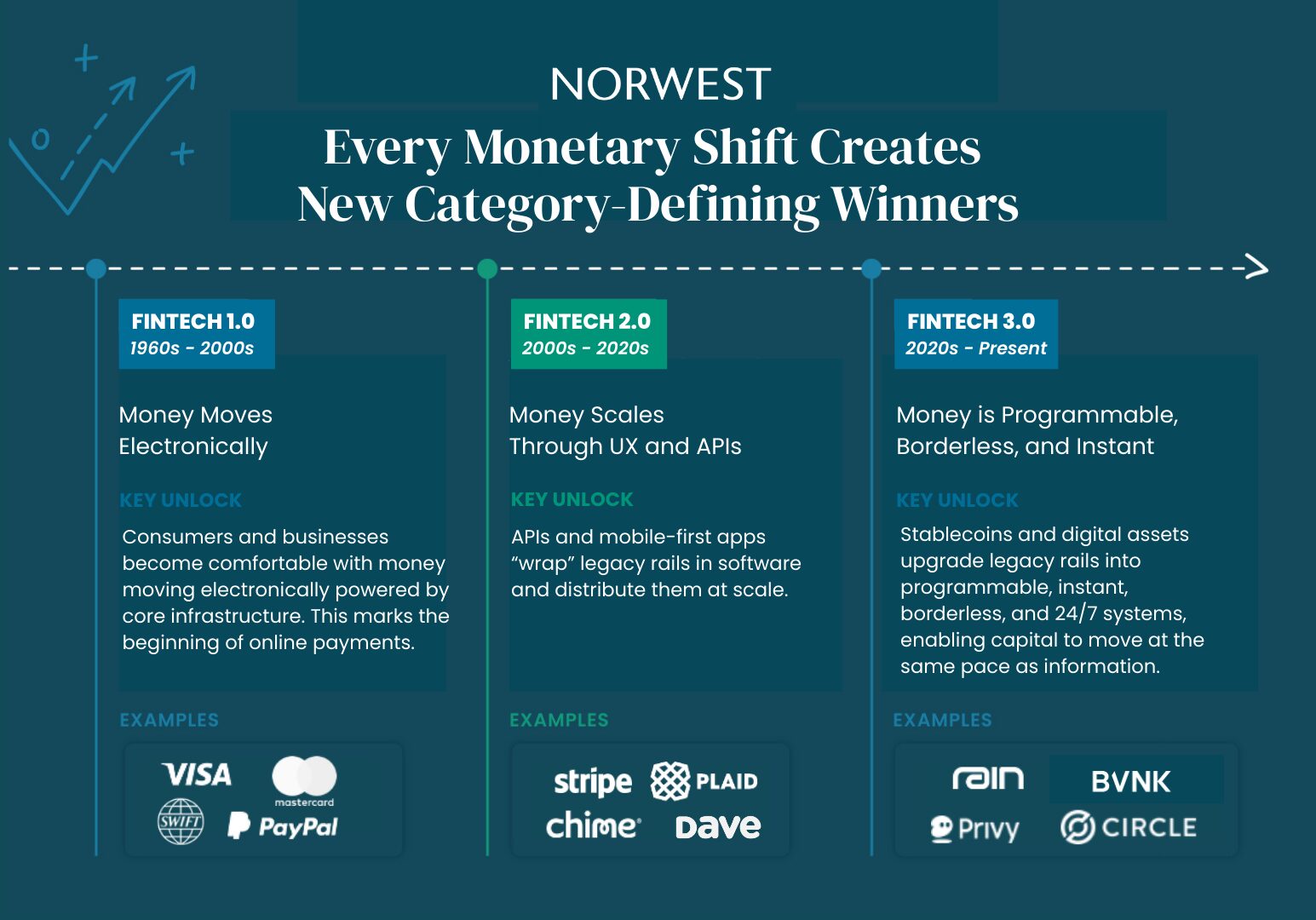

What is Fintech 3.0 and How Did We Get Here?

Fintech has evolved through three major eras, each defined by the underlying infrastructure that made it possible. Every era has unlocked new categories of value creation, enabling founders to build enduring companies that transformed how money moves.

Fintech 1.0 was the era of digitization. It brought financial services from paper to plastic, from in-person to electronic. Systems like SWIFT, ATMs, and card networks made money move electronically for the first time, and companies like Visa and Mastercard gave that technology global reach. For millions of consumers, a card swipe was their first digital transaction. These networks became the foundation of the modern payments industry, setting the stage for decades of innovation to come.

Fintech 2.0 scaled access. As the internet and mobile took hold, companies like Stripe, Norwest portfolio company Plaid, and a wave of Banking-as-a-Service providers (BaaS) emerged to abstract away much of the legacy financial infrastructure through APIs. They unlocked a new generation of consumer fintechs like Chime, Norwest portfolio company Dave, Robinhood, and others, that built elegant, mobile-first experiences on top of these providers. The shift was transformational: finance became user-friendly, on-demand, and embedded in everyday life. But the underlying rails remained the same: batch-based, slow, and bound by geography and time zones.

Now, Fintech 3.0 represents a far more fundamental change. This era isn’t just about making finance more accessible; it’s about rebuilding its foundation. Using stablecoins and digital asset infrastructure, today’s founders are upgrading the plumbing of the financial system itself. The new rails they’re building are programmable, instant, borderless, and 24/7. This isn’t just better interfaces but entirely new financial primitives that the prior eras were never equipped to handle.

Take Rain, a Norwest portfolio company, as an example. Rain provides stablecoin infrastructure that enables fintechs, financial institutions, and global platforms to issue stablecoin-linked cards to consumers and businesses. Its unique technology allows cardholders to check out at 150 million merchants as they would with any other credit card, but under the hood all settlement with Visa happens natively on the blockchain. What sounds incremental is actually transformational; Rain makes it possible for companies around the world to issue a compliant card that operates globally, in real time, using stablecoins as the underlying settlement medium.

Rain powers payment capabilities for a new generation of application-layer innovators like ether.fi, part of a fast-growing wave of stablecoin-native neobanks that help users around the world save, earn, and spend in digital dollars.

With stablecoins as the linchpin for Fintech 3.0, we are seeing the rise of incredible companies across the stack. Here’s how we view the landscape and map the companies within each layer:

The Stablecoin Stack

The stablecoin ecosystem has multiple layers that together power the issuance, movement, and utility of digital dollars. As the market continues to mature, we’re seeing companies expand their ambitions and move into adjacent parts of the stack. Rain dominates card issuance but has begun to expand into other areas of the infrastructure stack including wallets and pay-ins and pay-outs. Bridge has evolved from orchestration tooling into white-label stablecoin issuance. Plasma, a payment-focused chain, has launched Plasma One, its own stablecoin-native neobank. The stack is fluid, and the most ambitious teams are widening their product footprint to capture more of it.

Settlement Layer:

At the base of the stack is the settlement layer, the core blockchain layer where transactions are recorded, validated and finalized. This layer has historically been dominated by general purpose, permissionless blockchains (L1s) like Ethereum, Solana and Avalanche and scaling solutions (L2s) like Base and Optimism. We continue to see innovation here with the launch of newer EVM-compatible chains like Monad, that claim higher transaction throughput and faster finality.

Of late, we’re also witnessing the rise of purpose-built chains for specific payment and stablecoin settlement use cases like Arc, Tempo, and Plasma. These chains, with varying degrees of corporate Influence and permissions, are meant to support enterprise-grade throughput, performance, and privacy when needed.

As banks begin to play a more active role, post regulatory clarity in the US, permissioned and hybrid networks like Canton or Partior may also serve an increasingly important role.

Issuance Layer:

So far, stablecoin issuance has largely been a duopoly dominated by Circle ($75Bn total USDC supply) and Tether ($187Bn total USDT supply). Both enjoy years of earned trust and major distribution advantages, but that dominance may begin to come under pressure. With clearer regulation and the rise of open issuance platforms like Brale, Agora, and Bastion, a large number of new stablecoins are emerging for specific use cases. Recent stablecoin launches from Klarna (KlarnaUSD), Cloudflare (NET Dollar) and Phantom (CASH) suggest that the economic upside and flexibility of issuing a proprietary stablecoin, whether for payments, loyalty, or treasury efficiency, make it an increasingly compelling strategy for fintechs, corporates, and institutions alike.

Infrastructure Layer:

The infrastructure layer sits between stablecoin issuers and the applications that bring them to life. Enablers in this part of the stack provide the essential custody, compliance, licensing, and movement of value across blockchains, that makes stablecoins usable at scale. This layer includes embedded wallets, transaction orchestration, card issuance, and API-based money movement platforms that abstract away blockchain complexity, allowing developers to integrate stablecoins as easily as any other payment primitive.

Today, providers like Rain are defining this category. They handle the messy parts under the hood and make it possible for fintechs, corporates, and in the case of Norwest portfolio company, Stablecore, even traditional banks and credit unions to plug directly into stablecoin rails.

Distribution Layer:

The distribution layer is where stablecoins reach end users and merchants. It includes neobanks like Kast and RedotPay, remittance and P2P payment apps like Félix Pago and Sling Money, and B2B payment platforms like Acctual and Shield. From a user’s perspective, this is where stablecoins disappear into the background; funds move instantly, balances update in real time, and geography no longer defines access.

The Rails are Ready

At Norwest, we believe this is the next great fintech wave. As regulatory clarity converges with developer readiness, the pieces are finally in place for a new generation of founders to reimagine finance from the ground up.

As regulatory clarity converges with developer readiness, the pieces are finally in place for a new generation of founders to reimagine finance from the ground up.

Norwest has already backed this vision through our investments in Rain and Stablecore, two companies building critical infrastructure for the stablecoin economy.

They exemplify what we believe defines Fintech 3.0 founders: technical depth, regulatory fluency, and a commitment to making money movement as intuitive as information transfer.

The Future of Fintech 3.0

In the coming years, nearly all financial infrastructure will run on stablecoin rails and tokenized assets. The experience for consumers and businesses may look the same, a card swipe, a payroll deposit, a deposit transfer, but behind the scenes, the financial plumbing will be entirely rebuilt. Settlement will be instant. Liquidity will move continuously. And global finance will operate on infrastructure designed for the internet age, not constrained by time zones or batch systems.

In the coming years, nearly all financial infrastructure will run on stablecoin rails and tokenized assets. The experience for consumers and businesses may look the same, a card swipe, a payroll deposit, a deposit transfer, but behind the scenes, the financial plumbing will be entirely rebuilt.

Clear institutional momentum and emerging regulatory clarity are accelerating this shift by giving founders the confidence to build products that feel familiar on the surface but run on entirely new foundations. We’re already seeing it through the pioneering Fintech 3.0 founders in our orbit that we’ve had the privilege to partner with, and we’re eager to find and back more.

If you’re building the next generation of fintech, I’d love to chat with you!