When we first met the Hyro founders, CEO Israel Krush and CIO Rom Cohen, we saw a team uniquely equipped and determined to tackle one of the most underserved pain points in healthcare today: a broken patient experience (PX).

Health systems spend more than $24.8 billion* each year on call centers and PX operations, yet many patients sit on hold waiting to schedule appointments, refill prescriptions, or solve dozens of other issues. This gap goes beyond customer care, extending to the abandonment of revenue opportunities when patients are unable to complete tasks or access services.

The global AI in healthcare market is projected to grow at a CAGR of 38.62% from 2025 to 2030, representing an estimated market value of $187.69 billion. Hospital leaders across Information, Digital, and Patient Experience teams are driving this growth by making AI-driven automation a top priority to enhance efficiency, accuracy, and patient outcomes. The sheer scale of the market offers enormous opportunity for the right solution to make a real impact.

Breaking the Status Quo in Healthcare Contact Centers

Delivering production-ready voice and chat AI agents in healthcare requires deep domain expertise, compliance and reliability, solving for the complicated edge cases in the world of healthcare. Hyro’s no-code platform is designed to deliver enterprise-grade AI agents that productize and streamline complex healthcare workflows.

“Hyro’s no-code platform is designed to deliver enterprise‑grade AI agents that productize and streamline complex healthcare workflows.”

Rather than building one-off “bots”, the company offers a skill-based, verticalized platform that manages tasks such as authentication, routing, scheduling and prescription refills which account for nearly two-thirds of all calls and messages received by contact centers. By automating these support requests, Hyro customers have saved their front-line staff time and reduced call abandonment, resulting in consistent ROI of 4x to 10x.

These gains are complemented by qualitative benefits, including reduced workforce fatigue and improved patient satisfaction.

With Hyro, each AI agent operates as a skilled team member with deep, seamless integrations that easily plug into customer’s electronic health-record (EHR) systems, CRM platforms, and contact centers.

This approach allows health systems to go live within weeks, eliminating the need for system integrators and lowering the overall total cost of ownership.

Emerging Category Leadership and Strong Growth

In a market where nearly 95% of generative AI pilots at companies are failing according to a new report published by MIT’s Nanda initiative, Hyro is breaking the mold.

Earlier this year, the company drove the largest number of enterprise‑grade deployments within large health systems including Intermountain Health, Inova, Ben Secours Mercy Health, Baptist Health and more.

The Hyro team’s traction is buoyed by their relentless focus on product quality and a repeatable land-and-expand strategy. Current customers, including top CIOs and CIDOs, are also driving momentum through word-of-mouth, account referral, and sharing measurable ROI.

Health systems typically will start with inbound call deflection and then layer skills on top of that foundation, with increased complexity as they embed further with Hyro. As a result, Hyro maintains top quartile net retention with its customers.

“We believe Hyro is positioned as the leading healthcare-focused, enterprise-grade conversational AI platform.”

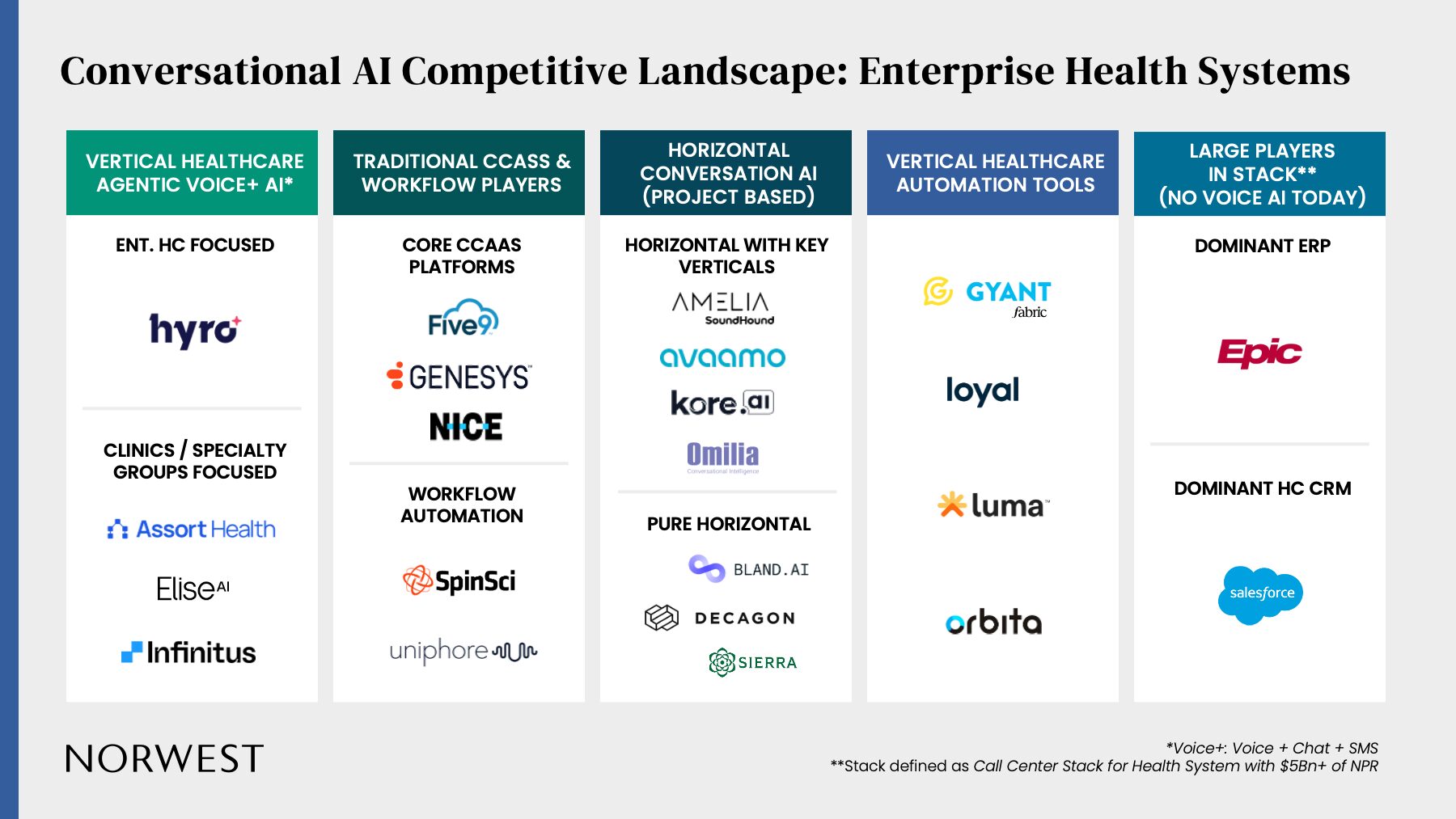

We’ve spent the past year analyzing the state of conversational AI in healthcare and have seen an explosion of new entrants: from horizontal platforms adding healthcare skills to niche workflow bots tackling isolated use cases. This research has strengthened our conviction that platforms that are deeply integrated into core healthcare applications and built to navigate healthcare’s unique complexity will generate the lion’s share of value.

AI agents operating in isolation without longitudinal patient data, identity resolution, or cross-channel logic will inevitably hit a ceiling. As automation layers scale, this depth becomes the difference between surface-level interaction and end-to-end resolution.

The market map below captures the breadth of current approaches and the differentiated position Hyro has built at the center of this emerging category.

Why Hyro Fits Our Strategy

At Norwest, we back category defining platforms with strong data foundations and measurable real-world impact. Hyro embodies that thesis. By productizing complex workflows and integrating multiple systems, it lowers barriers to AI adoption and delivers repeatable ROI.

“By productizing complex workflows and integrating multiple systems, Hyro lowers barriers to AI adoption and delivers repeatable ROI.”

Commercially, Hyro is increasingly regarded by health systems as a trusted partner, with the opportunity to deepen its role and progressively support broader patient experience engagements across voice communications. As part of this expansion, the company is well positioned to extend its impact into adjacent aspects of patient interaction, reinforcing its value as an enterprise-grade solution that strengthens both efficiency and patient engagement.

Proven Leadership with a Passion for Problem-Solving

Hyro’s leadership team brings the right mix of healthcare depth and scaling experience, with proven leaders across key departments.

CEO Israel Krush has spent over a decade on the frontlines of emerging technology developing software for companies like Intel and leading product for computer vision company, Zeekit (acquired by Walmart in 2021). CIO Rom Cohen earned his stripes developing IBM’s Turbonomic Autonomic Control Platform before co-founding Hyro.

Their team’s appetite for solving complex problems and passion for elevating customer experience enables them to execute with discipline while building traction with leading health systems and partners.

We’re proud to support Hyro on this journey and look forward to working alongside Israel, Rom and the whole Hyro team as they continue to bring enterprise-grade conversational AI to healthcare.

Notes:

*$24.8B is our conservative Norwest estimate which assumes an 8 – 12x ROI for Health Systems from AI (which reduces spend therefore by 8-12x) as well as reducing the medium-term conversational automation rate to only focus on low to mid complexity skills (~40% automation) versus other reports with higher projected conversational automation rates.